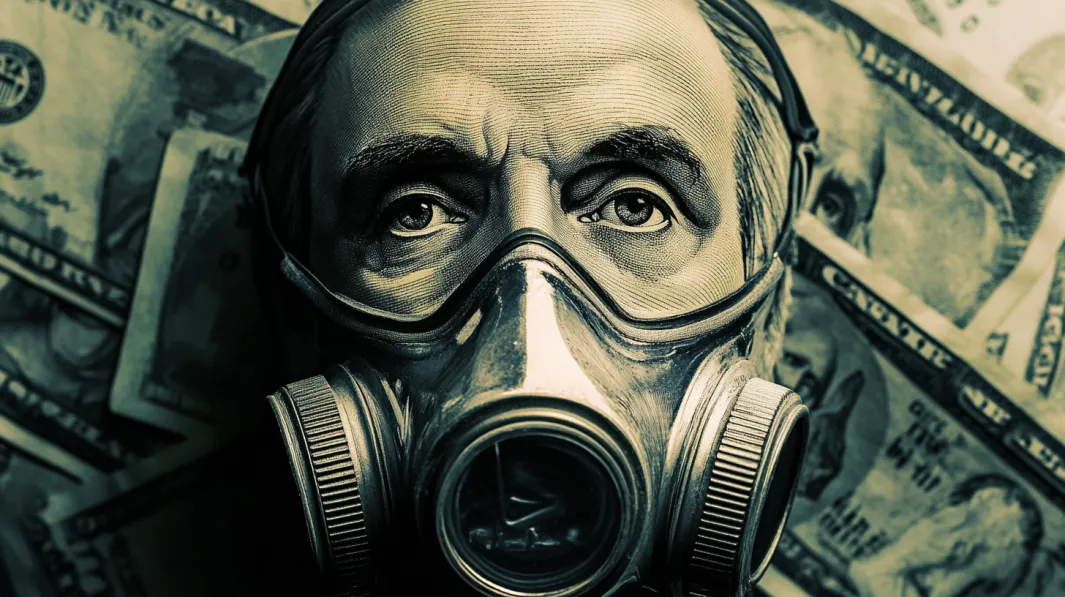

Government Introduces 'Breathing Tax' to Combat Air Pollution

In a bold move to address escalating environmental concerns, the federal government announced today the implementation of a new "Breathing Tax" aimed at reducing air pollution and promoting public health. The legislation, officially titled the "Respiratory Contribution Act," mandates that all citizens participate in a program designed to monitor and tax individual carbon dioxide emissions resulting from exhalation.

A Revolutionary Approach to Environmental Conservation

Environment Minister Dr. Eleanor Green unveiled the policy during a press conference at the National Climate Center. "Human respiration contributes significantly to carbon dioxide levels in the atmosphere," Dr. Green stated. "By holding ourselves accountable for our personal emissions, we take a crucial step toward mitigating the effects of climate change."

The tax will be calculated based on the average number of breaths an individual takes per day. To facilitate accurate monitoring, the government will distribute wearable devices—dubbed "Breath Trackers"—which record respiratory rates and transmit data to the newly established Department of Personal Emissions.

How the Tax Works

Every citizen over the age of five will be required to wear a Breath Tracker at all times, except when sleeping. The device measures each inhalation and exhalation, calculating daily carbon dioxide output. Monthly statements will be sent to households, detailing the total breaths taken and the corresponding tax owed.

The tax rate is set at $0.01 per 100 breaths, with adjustments made for individuals engaged in high-intensity activities that naturally increase respiratory rates. Athletes and manual laborers may apply for exemptions or reduced rates through a formal appeal process.

Government Justification and Goals

Proponents of the Respiratory Contribution Act argue that the policy incentivizes citizens to adopt practices that reduce unnecessary breathing, such as engaging in mindfulness and meditation techniques. "Not only will this tax encourage people to be more conscious of their breathing patterns, but it will also promote mental well-being," said Dr. Green. "It's a win-win for both the planet and personal health."

The government projects that the tax will generate an estimated $50 billion annually. Funds collected will be allocated to renewable energy projects, reforestation efforts, and the development of carbon capture technologies.

Public Reaction

The announcement has been met with a mix of support and skepticism. Environmental groups praise the government’s innovative approach. "This is the kind of forward-thinking policy we need to combat climate change effectively," said Lisa Patel, director of the Global Green Initiative. "By taking responsibility for our own emissions, we set a powerful example for the rest of the world."

However, civil liberties organizations and members of the public have raised concerns about privacy and personal freedom. "Mandating that citizens wear devices to monitor their breathing is a gross invasion of privacy," argued Thomas Reed, spokesperson for the Freedom for All Coalition. "What's next—taxing people for thinking too much because it burns calories?"

Social media platforms are abuzz with hashtags like #BreatheFree and #AirTax, reflecting widespread debate over the new policy.

Economic Implications

Economists are divided on the potential impact of the Breathing Tax. Some believe it could lead to reduced consumer spending due to the additional financial burden on households. Others argue that the revenue generated will stimulate the economy through government investment in green technologies.

Small businesses are also assessing the implications for their operations. Industries that require physical labor may face challenges as employees seek to minimize their breathing to reduce personal costs, potentially affecting productivity.

Legal Challenges Anticipated

Legal experts predict that the Respiratory Contribution Act will face immediate challenges in court. Constitutional scholars question the legality of taxing a basic human function. "Breathing is an involuntary action essential to life," noted Professor Margaret Ellis of the National Law University. "Imposing a tax on it raises serious ethical and legal questions that the courts will need to address."

Implementation Timeline

The government plans to roll out the Breath Trackers over the next six months, with full compliance expected by July 2025. A nationwide informational campaign will precede the rollout, aiming to educate citizens on how to use the devices and understand their tax statements.

Non-compliance will result in penalties ranging from fines to mandatory environmental education courses. Repeated offenses could lead to more severe legal consequences.

Conclusion

The introduction of the Breathing Tax marks a significant moment in the government's approach to environmental policy. As the nation grapples with the realities of climate change, this legislation represents an ambitious attempt to involve every citizen in the fight against global warming.

Whether the Respiratory Contribution Act will achieve its intended goals or face insurmountable opposition remains to be seen. What is clear, however, is that the conversation around environmental responsibility has taken an unprecedented turn, placing the very act of breathing at the center of national discourse.

Neverland Times

Neverland Times